Project Overview

Over several weeks in August 2010, multiple teams comprised of federal agency representatives, economic development organizations and experts in economic development deployed to the Gulf Coast region to conduct a series of economic development needs assessments in 19 counties affected by the oil spill. These trips followed the completion of two "pilot" trips in June and July. This effort is part of the Obama Administration’s response to the Deepwater Horizon oil spill and was carried out through the National Incident Command, Economic Solutions Team. A grant from the U.S. Department of Commerce’s Economic Development Administration was awarded to the International Economic Development Council to assist in conducting the assessments.

The 21 total teams, included 125 federal participants and 105 economic development experts, visited five states Florida, Louisiana, Alabama, Mississippi, Texas to conduct a 3 day assessment holding 672 meetings with approximately 1,281 people representing 854 entities. The objective of these qualitative assessments was to provide multi-disciplinary, customized, and capacity-building technical assistance for impacted communities. The assistance was designed to foster each community’s ultimate development of its own strategies for economic recovery.

Each site visit was structured to meet with a wide swath of key stakeholders from different sectors of the local community, including economic development leaders, political leaders, local government officials, business owners, workforce intermediaries, educational leaders, financial sector representatives, etc. Based on stakeholder-identified economic development needs, the assessment teams identified possible short- and medium-term strategies towards economic recovery that communities could consider.

Due to the contours of this project, these teams did not conduct economic analyses or investigate the causes of any reported economic downturn or economic distress in the communities visited. The teams also did not independently verify the information provided to them by the stakeholders or the sources of data compiled outside of the federal government. The project was focused on providing comprehensive, customized, and capacity-building technical assistance from economic development and recovery experts.

The findings of the assessment and evaluation teams informed the development of comprehensive framework for Gulf Coast recovery provided in Secretary of the Navy Ray Mabus’ report, America’s Gulf Coast: A Long Term Recovery Plan After the Deepwater Horizon Oil Spill (“Mabus Plan”). Specifically, the teams’ findings were instrumental in shaping the economic section of the report. That report is available here: http://www.restorethegulf.gov/release/2010/09/28/america%E2%80%99s-gulf-coast-long-term-recovery-plan-after-deepwater-horizon-oil-spill.

As described in the Mabus report, the teams’ firsthand conversations with community stakeholders contributed to the identification of a number of key principles for economic recovery. Those include:

- Affected communities can benefit greatly from economic assessment, technical assistance, and capacity building. Specifically, analytical capacity and assistance with navigating federal and state programs and non‐governmental resources can help recovering communities. The economic assessment and evaluation teams helped to provide this kind of resource both through their visits and through the follow-up reports that have been shared with communities. Additionally, the Department of Commerce is coordinating a set of technical assistance seminars which will provide communities with additional opportunities to learn more about relevant federal programs, and about best practices for engaging with the private and philanthropic sectors.

- Addressing public perception concerns and mitigating long‐term reputational damage in the wake of this spill will be central to economic restoration. The teams found that this of particular concern with respect to the tourism and seafood industries – both of which are significant drivers of the Gulf economy. The teams’ reports include a number of suggestions and best practices for ways that communities can address these challenges – including strategies for developing an approach to communications and marketing with respect to affected industries.

- The pace of small business recovery will be central to the recovery of communities across the Gulf Coast. Support for small businesses is a vital component of recovery. Small businesses are critical to the long‐term health and economic recovery of the Gulf Coast. Small business is one of the drivers of local economies and one of the first catalysts of economic recovery. Small businesses tend to be more vulnerable to shocks than big firms but, with the right tools, small businesses can adapt and benefit from recovery and restoration, too. Many of the suggestions described below are geared specifically towards small businesses.

- Recovering regions should use the opportunities presented by the recovery effort to address longstanding economic and environmental challenges. To that end, many of the assessment and evaluation teams’ conversations focused on communities ideas for diversification of their economies.

In all of these areas and others, the Mabus report offers additional context on federal activities, as well as recommendations for future federal efforts.

Following up on the teams’ visits, each community has received a customized report, based on the conversations that the teams had with stakeholders in the communities. The reports provide a number of suggestions that communities may consider in developing their own economic development strategies. Many of these suggestions are based on common best-practices in economic development. Because these best-practices can be adapted for implementation in many communities, in addition to those that participated in the site visits, they are also summarized in this document.

Potential Recovery and Economic Development Strategies for Communities to Consider

Each community has unique attributes, assets and recovery/economic development needs. The assessment and evaluation teams worked closely with local stakeholders to understand their individual characteristics and needs. The individual reports reflect analysis of specific assets, economic development resources, and key recovery areas in each community. Over the course of the visits, a number of common themes began to emerge, as described above.

This compilation includes a number of best-practices geared towards addressing concerns that emerged across communities. These are organized along the lines of the principles discussed above.

This guide also includes a compilation of best practices for access to capital – as communities expressed significant concerns across the board about the issue of capital access. This compendium is included as Appendix 1 in this overview document.

Economic Assessment, Technical Assistance, and Capacity Building

Encourage awareness about the claims process and its eligibility protocols

For individuals and small businesses in tourism-related industries, as well as others whose wages and business have been impacted by the Deepwater Horizon oil spill, lost profits and impairment of earning capacity may be recouped through the claims process, which is being administered independently by the Gulf Coast Claims Facility (GCCF). A good understanding of the claims process, eligibility rules, and application procedures may be important to recouping income, where appropriate.

More information is available via the GCCF (http://www.gulfcoastclaimsfacility.com). Additional information is available here (http://www.restorethegulf.gov/release/2010/09/28/america’s-gulf-coast-long-term-recovery-plan-after-deepwater-horizon-oil-spill

Communities may want to consider offering technical assistance to individuals and small businesses that have difficulty managing the claims process. Some community members have articulated challenges with filling out forms, providing adequate documentation, and translation. Moreover, claim recipients may benefit from assistance with financial literacy – a challenge identified in Secretary Mabus’ recent report

(http://www.restorethegulf.gov/sites/default/files/documents/pdf/gulf-recovery-sep-2010.pdf, p.83).

As discussed in the challenges above, claims recipients, as well as others impacted by the spill, may also benefit from additional information to assist with tax-related questions. The IRS has already taken a number of steps to assist taxpayers impacted by the oil spill. To help with questions and issues, the IRS has posted the answers to frequently asked questions on its website (http://www.irs.gov/pub/irs-pdf/p4873a.pdf) and has established a dedicated phone line (866-562-5227) to deal with taxation questions arising from the oil spill. In addition, the IRS has announced a number of options available to assist taxpayers experiencing hardship due to the spill. Options include postponement of collection actions or added flexibility to coordinate installment agreements. These steps are described in greater detail in Secretary Mabus’ report.

Organizing for recovery: Developing a Post-disaster Economic Recovery Task Force

A consistent best-practice in a post-disaster environment is the establishment of local task forces of community stakeholders to meet regularly and deliberately advance recovery initiatives in their community. Many communities have employed this tactic; such as after major flooding in Iowa, after Hurricane Katrina, and even after the oil spill in Baldwin County, Alabama. One of the greatest advantages that a post-disaster economic recovery task force could offer a community is the organizational momentum to continue recovery activities. A task force could be organized into sub-elements that could center on targeted recovery challenges, including business retention and expansion, workforce development and education, economic diversification, and marketing and communication issues. The task force could serve as the central organizing element to coordinate all other recovery efforts and serve as the local “authority” to push these efforts with local elected officials, regional organizations, state officials, and federal agencies.

Local economic development leaders could serve as facilitators in recovery discussions and could identify available resources. They can also help ensure follow-up once task force initiatives are spelled out.

Marketing and Communication strategies

Given the persistent negative public perception of the oil spill’s impact on the Gulf Coast, many of the communities could work with regional and state partners to develop a joint strategy for reinvigorating the Gulf Coast “brand.” There may be an opportunity for the communities, and the region as a whole, to implement a retrenching strategy as environmental safety concerns abate. Some objectives for this strategy are building back brand confidence and supporting immediate tourism business needs.

Other tactics the communities could implement to address perception concerns include facilitating local familiarization tours with site selectors, travel editors, and media professionals. These tactics, coupled with efforts to expand the geographic “footprint” of the tourism market, could be helpful in shifting of the region’s image in a positive direction.

A regional branding effort, potentially lead by a multi-state campaign could serve to strengthen the region’s image. In addition, a coordinated marketing strategy for all Gulf Coast states might serve to repair the damaged brand and improve tourism rates for coastal communities impacted by the disaster.

Supporting Small Businesses

Business retention, expansion, and attraction are often central elements of a community’s economic development program. Focusing on this element in the post-disaster economic recovery is a logical starting place. Identifying key economic development partners, both traditional and new, could also help the community with these efforts. These efforts should have specific outreach to major and independent companies that engage in the community’s targeted industries. A proactive retention program is important in the short term to identify businesses in danger of failing and take steps to keep them viable. In the medium and long term, a business retention program should proactively assess business needs and impediments to growth.

Encourage Entrepreneurism and New Business Attraction

The role of the economic developer is to ensure that development pieces are in place and to serve as a facilitator who creates and connects resources to meet needs throughout all elements of the entrepreneurial ecosystem. Through efforts that increase the capacity for people, businesses and institutions to engage in entrepreneurship, economic developers can unlock the latent potential within their communities for sustained economic growth.

Existing entrepreneurs within a community should be tapped to serve as mentors and key connectors to drive the creation of a deeper network of entrepreneurship. Information and local resources could be leveraged to target adults who have skills that have the potential to be the basis for home-grown businesses. Communities could utilize resources such as local universities, community and technical colleges and nonprofit organizations to help stimulate entrepreneurial growth. Likewise, state resources, such as small business development centers, provide both start-up assistance and training for early-stage firms.

Develop creative marketing strategies to support affected businesses

Local tourism development organizations and chambers of commerce should spearhead an effort to develop creative marketing strategies for the off-peak seasons utilizing their network of business owners. Incentive programs to attract visitors to the area through the fall and winter could be explored, such as those that were implemented over the summer using BP tourism funding. Also, some communities that the EST visited relied on tourists from adjacent states. Communities could attempt to expand the “footprints” of their tourism markets through increased outreach efforts (e.g., social media, marketing partnerships with air carriers, sister city programs, familiarization tours). Additionally, communities could implement programs to encourage local residents to buy local and therefore reduce the retail leakage that was a concern for several communities. Some examples include group discounts, marketing events, or forming a network of referrals to neighboring business owners. The communities could also further market their non-coastal natural, historical, or recreational assets as tourist attractions.

Improve Capital Access

In response to the concerns raised by Gulf communities over the course of the economic assessment and evaluation teams’ visits, the Economic Solutions Team compiled a guide to certain best-practices and existing resources that may be helpful to communities in addressing some of these critical challenges. This information is included here as an appendix.

Economic Diversification and Resiliency

Communities across the Gulf Coast have almost uniformly articulated a strong desire to diversify their economies, often noting that the oil spill revealed that their economies are too narrowly concentrated. Many communities had plans to diversify before the oil spill occurred and they expressed frustration that recent progress towards realizing projects such as airports and shipping ports might be stymied by the oil spill. Moreover, communities articulated the need for workforce retraining to support economic diversification. Disasters can provide an opportunity to address longstanding challenges and to reconsider fundamental questions about a community or region’s economy and future direction. By incorporating preexisting ideas about diversification into the long-term economic response, the Gulf Coast can use its valuable assets to move toward a 21st Century economy and workforce.

The economic diversification of a region is a long-term undertaking which requires dedication on the part of local stakeholders. Should the community pursue diversification, however, some efforts can begin immediately. The complexities of diversification often require that communities form strong public/private partnerships, develop reliable new funding streams, and adapt to new conditions in an economy. This is the stage where the community moves from stabilization to sustaining itself. The central task of this stage will be for the community to decide which of the short-term stabilization measures need to be made permanent. While the life preservers of the short term are still important, this stage of recovery demands that the community step outside of day-to-day survival thinking and transition to thinking about building capacity for tomorrow.

Effective economic development investment and capacity building requires long-term strategic thinking that is flexible enough to respond to emerging opportunities. In the medium term, the role of the local leadership could be to further the efforts of the economic recovery and connect public and private resources for building back a more resilient economy. The efforts initiated in the short term will also need to be extended and deepened to have extensive interdependency with business retention, industry reinvigoration, and marketing efforts.

Workforce Development and Education: Transferable Skills Analysis (TSA)

The alignment of economic and workforce development is important as a recovery strategy – and particularly as communities pursue their diversification goals. The key skills for success in a globalizing, changing economy include portability and flexibility. With sectors and economies changing, having a strong labor pool and enabling the inclusion of workers into new opportunities necessitates a proportional effort in enhancing workforce skills.

One focus of community workforce development efforts could be to conduct a formal transferable skills analysis (TSA) through direct interviews with displaced workers from within the community. The TSA is conducted by a professional business counselor to examine an individual’s work history and to highlight areas of expertise and skills that might otherwise go unnoticed. Examples of analyzed items include the work activities a person has performed in prior employment, evidence of work product (e.g. materials, portfolio, subject matter, and services), other skills from personal hobbies, and volunteer experiences.

This data could then be used not only to identify a set of occupations a worker could perform, but could also be compiled into a larger database to create a skillshed of the community as a whole. A skills analysis of a community could be used to identify needed areas for retraining, placement, and entrepreneurship development. This could guide local workforce agencies, community colleges, employers and business groups in filling these needs.

In addition, the community and local economic and business organizations could work with the local workforce board to connect displaced workers with local businesses.

Appendix 1: Access to Capital -- Strategies for Communities to consider

Introduction

Communities, individuals, and government entities across the country face challenges related to accessing capital. Often, there are creative approaches that can be employed in order to better leverage Federal, state, and non-governmental programs in order to make the most of limited resources.

In response to the concerns raised by Gulf Coast communities over the course of the economic assessment and evaluation team visits, the National Incident Command Economic Solutions Team has compiled a guide to a sample of best-practices and existing resources that may be helpful to communities in addressing some of these critical challenges.

This guide is included as part of an online technical assistance tool to support all communities that may be able to benefit from this information. The guide includes an assortment of best-practices, as well as information on related federal programs. It is our hope that this guide will inform efforts at the local-level and direct communities towards resources that will help them grow local businesses and improve local economies.

Revolving Loan Fund Programs

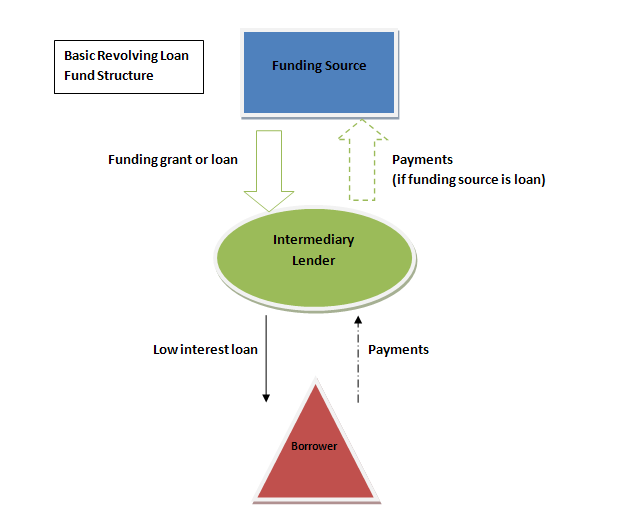

Revolving loan fund (RLF) programs are gap financing systems commonly used to provide a flexible source of capital that can be used to support, develop, and grow businesses. Generally, RLFs work by awarding grants or providing loans to applicants that serve as intermediary lenders and that, in turn, make loans from their RLFs to small businesses or businesses that cannot borrow capital from standard commercial lenders (see graphic below). Often, though not always, the loans between the intermediary and the business have favorable terms and are at below market interest rates. Many RLF programs are designed to help business borrowers become financially independent and eligible for loans from traditional commercial lenders. Generally, as the loans are repaid, the intermediary lender uses a portion of interest earned to pay administrative expenses and adds remaining principal and interest repayments to the RLF’s capital base to make new loans. Economic development organizations in communities impacted by the oil spill can apply for funding as intermediary lenders and potentially receive funding with which to provide revolving loans to local businesses.

Some Federal Government Funding Sources for RLF Programs Include:

U.S. Department of Agriculture Intermediary Relending Program (IRP) (http://www.rurdev.usda.gov/rbs/busp/irp.htm)

The IRP program is a loan program administered by the U.S. Department of Agriculture/Rural Development that provides loans to local organizations (intermediaries) for the establishment of revolving loan funds. These revolving loan funds are used to assist with financing business and economic development activity to create or retain jobs in disadvantaged and remote communities. Intermediaries are encouraged to work in concert with State and regional strategies, and in partnership with other public and private organizations that can provide complimentary resources.

- AGENCY: Department of Agriculture (USDA) / Rural Development (RD) / Rural Business-Cooperative Service (RBS)

- RECIPIENTS: States, localities, nonprofit organizations.

- PURPOSE: To finance business facilities and community development projects not located within the outer boundary of any city having a population of 25,000 or more. Funds will also be available to intermediaries who will make loans for expenses that come as a consequence of a natural disaster.

- ASSISTANCE PROVIDED: Revolving loan fund administered by a federally approved intermediary.

- ELIGIBILITY: Nonprofit corporations, public agencies, Indian tribes, and cooperatives.

- CONTACT:

U.S. Department of Agriculture / RBS

South Agriculture Building

1400 Independence Avenue SW, Room 6867

Stop 3225

Washington, DC 20250-3225

202-690-4100 (FTS is not available)

- ADDITIONAL INFORMATION: http://www.rurdev.usda.gov/BCP_irp.html.

- CFDA NUMBER: 10.767 Intermediary Re-lending Program

U.S. Department of Agriculture Rural Business Enterprise Grants (RBEG) Program (http://www.rurdev.usda.gov/rbs/busp/rbeg.htm)

The RBEG program is a grant program administered by the U.S. Department of Agriculture Rural Development that provides grants for rural projects that finance and facilitate development of small and emerging rural businesses help fund business incubators, and help fund employment related adult education programs. To assist with business development, RBEGs may fund a broad array of activities.

- AGENCY: U.S. Department of Agriculture / Business and Cooperative Programs

- RECIPIENTS: Rural communities.

- PURPOSE: To facilitate the development of small and emerging private business, industry, and related employment for improving the economy in rural communities. Funds may be used to create, expand, or operate rural distance learning networks or programs that provide education or job training instruction related to potential employment or job advancement for adult students; to develop, construct, or acquire land, buildings, plants, equipment, access streets and roads, parking areas, utility extensions, necessary water supply and waste disposal facilities; refinancing; services and fees; and to establish a revolving loan fund. All uses must assist a small and emerging private business enterprise.

- ASSISTANCE PROVIDED: Project Grants ($100,000 average).

- COST-SHARING REQUIREMENTS: None.

- ELIGIBILITY: Local governments serving populations of less than 50,000; nonprofit corporations serving rural areas; and Indian tribes on Federal or State reservations which serve rural areas.

- APPLICATION: Applicants should consult the office or official designated as the single point of contact in his/her State for more information on the process the State requires to be followed in apply for assistance. Pre-application coordination and an environmental impact assessment are required for this program.

- CONTACT:

Director, Specialty Programs Division

Rural Business-Cooperative Service

U.S. Department of Agriculture

1400 Independence Avenue SW

Washington, DC 20250

202-720-1400- ADDITIONAL INFORMATION: http://www.rurdev.usda.gov/BCP_rbeg.html.

- CFDA NUMBER: 10.783 Rural Business Enterprise Grant

U.S. Department of Agriculture Rural Economic Development Loan (REDL) and Grant (REDG) Programs

The REDL and REDG programs are administered by the U.S. Department of Agriculture/Rural Development that provides financing to eligible Rural Utilities Service (RUS) electric or telecommunications borrowers (Intermediaries) to promote rural economic development and job creation. The REDL zero-interest loans are made to Intermediaries, to relend, at a zero-interest rate, to small businesses. The small businesses are responsible for repayment to the Intermediary. The REDG grants are made to Intermediaries to establish revolving loan funds. REDG loans are made by the Intermediary from the revolving loan fund to small businesses for the purpose of financing specific, approved projects. The small businesses are responsible for the repayment to the intermediary

- AGENCY: Department of Agriculture (USDA) / Rural Development (RD) / Rural Business-Cooperative Service (RBS)

- RECIPIENTS: Eligible RUS electric or telecommunications borrowers.

- PURPOSE: To provide financing to small businesses for business purposes that will promote rural economic development and create and save jobs.

- ASSISTANCE PROVIDED: To RUS electric and telecommunications borrowers which in turn provide loans to small businesses.

- ELIGIBILITY: Eligible electric and telecommunications borrowers.

- CONTACT: U.S. Department of Agriculture / RBS

South Agriculture Building

1400 Independence Avenue SW, Room 6867

Stop 3225

Washington, DC 20250-3225

202-690-1400 (FTS is not available)- ADDITIONAL INFORMATION: (http://www.rurdev.usda.gov/rbs/busp/redl.htm)

- CFDA NUMBER: 10.854 Rural Economic Development Loans and Grants

U.S. Department of Commerce/ Economic Development Administration Economic Adjustment Assistance Program/Revolving Loan Fund (RLF) (http://www.eda.gov/AboutEDA/RLF.xml)

The Economic Adjustment Assistance Program is a program through which the Economic Development Administration’s regional offices award competitive grants to units of local government, state governments, institutions of higher education, public or private non-profit organizations, EDA-approved economic development district organizations, and Indian Tribes to establish RLFs.

- AGENCY: Department of Commerce (DOC) / Economic Development Administration (EDA)

- RECIPIENTS: States, localities, nonprofit organizations, Indian tribes.

- PURPOSE: To respond to the short- and long-term effects of severe economic dislocation events on communities.

- CAPITALIZE OR RECAPITALIZE REVOLVING LOAN FUND: Revolving loan fund recipients use grant funds to make low cost loans to businesses in their lending area. Categorical project economic adjustment grants (often funded from supplemental appropriations) for planning, technical assistance, revolving loan funds, and infrastructure construction to assist affected communities in accelerating economic recovery and implementing strategic actions to reduce the risk of economic damage and loss in commercial and industrial areas from future disasters.

- COST-SHARING REQUIREMENTS: Applicable cost-share requirements for economic adjustment assistance are set forth in current EDA regulations for grant rate eligibility (13 CFR 301.4).

- ELIGIBILITY: An eligible applicant may be a state, city, or other political subdivisions of a state; or a consortium of political subdivisions, an economic development district, or a public or private nonprofit organization or association acting in cooperation with officials of a political subdivision; an institution of higher education, or a consortium of institutions of higher education; or an Indian tribe. Area eligibility requirements, including special area eligibility due to a disaster declaration, are set forth in EDA’s current regulations and Federal Funding Opportunity (FFO). More detailed information regarding EDA’s program procedures, regulations, FFOs, and other requirements are available at EDA’s website.

- CONTACT:

Maureen Klovers

Economic Development Administration

Herbert C. Hoover Building, Room 7019

1401 Constitution Avenue NW

Washington, DC 20230

202-482-2785

mklovers@eda.doc.gov- ADDITIONAL INFORMATION: www.eda.gov.

- CFDA NUMBER: 11.307 Economic Adjustment Assistance

U.S. Department of Housing and Urban Development Community Development Block Grant (CDBG) Program

CDBG dollars can be used as a source of funding for RLFs. However, use of CDBG funds means complying with requirements of the Housing and Community Development Act. CDBG funding can also be used to help fund microenterprise development activity. As such, these funds can used by micro-lenders as non-federal matching funds against dollars borrowed from the SBA.

- CONTACT:

Mark S. Walling

Office of Block Grant Assistance

Department of Housing and Urban Development

451 Seventh Street SW, Room 7282

Washington, DC 20410-7000

202-402-5441

mark.s.walling@hud.gov- ADDITIONAL INFORMATION: http://www.hud.gov/offices/cpd/index.cfm.

- CFDA NUMBER: 14.218 Community Development Block Grants/Entitlement Grants

Revolving Loan Funds are already in extensive use in the Gulf Coast region. Gulf Coast counties and parishes may wish to use some of their state’s revolving loan funds as models. Local revolving loan funds include:

- Alabama

- Baldwin County Economic Development Alliance Revolving Loan Program (http://www.baldwineda.com/finance/bceda_revolving_loan_fund.htm)

- The South Alabama Regional Planning Commission Revolving Loan Fund (http://www.sarpc.org/rlf.asp)

- Florida

- Florida’s Great Northwest Rural Community Development Revolving Loan Fund (http://www.floridasgreatnorthwest.com/BusinessEnvironment/EconomicIncentives.html)

- Gulf Coast Electric Cooperative Revolving Loan Fund (http://www.gcec.com/community.aspx?id=87)

- South Florida Regional Planning Council Revolving Loan Fund (http://www.sfrpc.com/rlf.htm)

- Louisiana

- Jefferson Parish Economic Development Commission HUD CDBG Revolving Loan Program

(http://www.jedco.org/business-financing/50-hud-community-development-block-grant-revolving-loan-fund)

- St. Tammany Economic Development Foundation

(http://www.stedf.org/services.htm)

- Terrebonne Revolving Loan Fund for Small Businesses

(http://www.tpeda.org/ApplicationForm.aspx)

- Regional Loan Corporation

- Mississippi

- Mississippi’s Capital Improvement Revolving Loan Program[1] (http://www.mississippi.org/index.php?id=54)

- Texas

- Houston Business Development, Inc. Loans

(http://www.hbdinc.org/loanprograms.php?content=loan-information)

Micro-loan Programs

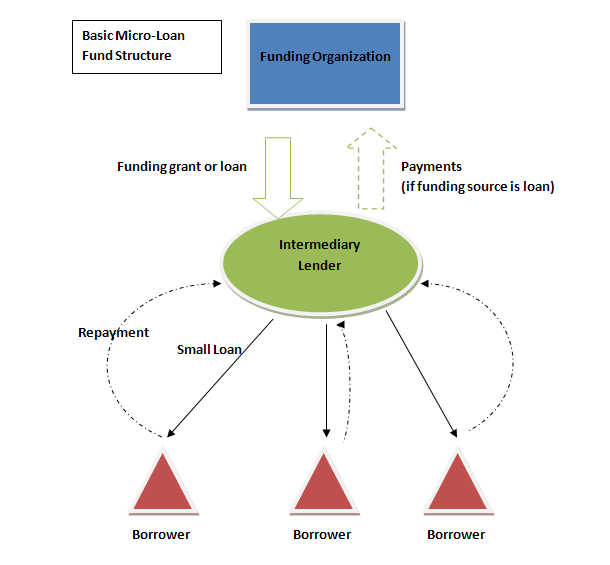

Micro-lending is an economic development tool that has been in use in this country since the late 1980s. Much like the revolving loan program discussed above, micro-loan programs often involve a funding entity that provides capital to intermediary lenders. These lenders, in turn, make loans to eligible micro-borrowers, often with favorable terms and generally at slightly higher than market interest rates. Micro-loan programs, however, are generally distinguished by the relatively small size of the loans, which are often just a few thousand dollars (for example, the Small Business Administration’s micro-loan program has an average loan size of about $13,000). Economic development organizations in communities impacted by the oil spill can apply for funding as intermediary lenders and potentially receive funding with which to provide micro-loans to small local businesses.

Some Federal Government Microloan Funding Programs Include:

U.S. Small Business Administration Microloan Program (http://www.sba.gov/financialassistance/borrowers/guaranteed/mlp/index.html)

The Microloan Program provides small, short-term loans to small business concerns as well as not-for-profit child-care centers. SBA makes funds available to specially designated intermediary lenders, which are nonprofit community-based organizations with experience in lending as well as management and technical assistance; these intermediaries make loans to eligible borrowers. The maximum loan amount available to an intermediary lender is $750,000 with a total aggregate debt allowed of up to $5 million. The maximum loan that an intermediary may make is $50,000. The mean average microloan amount is just under $13,000.

- AGENCY: Small Business Administration

- RECIPIENTS: Quasi-governmental economic development corporations, Native American Tribes

- PURPOSE: Provide small, short-term loans to small business concerns as well as not-for-profit child-care centers.

- ASSISTANCE PROVIDED: Proceeds from micro-loans may be used only for working capital and acquisition of materials, supplies, furniture, fixtures, and equipment. Loans cannot be made to acquire land or property.

- COST-SHARING REQUIREMENTS: The intermediary must contribute from non-Federal sources an amount equal to at least 15 percent of any loan that it receives from SBA. The contribution may not be borrowed. For purposes of this and other federal programs, Community Development Block Grants are considered non-Federal sources.

- ELIGIBILITY: To become an intermediary lender, applicants must meet three general criteria: 1) Be organized as a nonprofit organization, quasi-governmental economic development corporation, or an agency established by a Native American Tribal Government; 2) have made and serviced short-term fixed rate loans of not more than $50,000 to newly established or growing small businesses for at least one year; and 3) have at least one year of experience providing technical assistance to its borrowers.

- CONTACTS:

Alabama District Office

Tom Todt, District Director

801 Tom Martin Drive, Suite #201

Birmingham, AL 35211

Phone: (205) 290-7101

Jacksonville District Office

Wilfredo J. Gonzalez, District Director

7825 Baymeadows Way, Suite 100B

Jacksonville, FL 32256 - 7504

(904) 443-1900

Louisiana District Office

Michael W. Ricks, District Director

365 Canal St., Suite 2820

New Orleans, LA 70130

(504) 589-6685

Gulfport Branch Office

Judi N. Adcock, Gulfport Branch Manager

Hancock Bank Plaza

2510 14th Street, Suite 103

Gulfport, Mississippi 39501

(228) 863-4449

Houston District Office

Manuel R. González, District Director

8701 S. Gessner Drive, Suite 1200

Houston, Texas 77074

(713) 773-6500

- ADDITIONAL INFORMATION: www.sba.gov

U.S. Department of Health and Human Services, Administration for Children and Families, Job Opportunities for Low-Income Individuals (JOLI) Program

The purpose of the JOLI program is to create new jobs to be filled by low-income individuals. JOLI grantees create jobs through business plans and the provision of technical and/or financial assistance to private employers in the community. The ultimate goal of the JOLI program is economic self-sufficiency for the targeted populations.

Each year approximately 10 grants are awarded with the maximum grant award being $500,000. A minimum of twenty percent of the total JOLI funds must be used toward the provision of direct financial assistance to participants. Financial assistance may be provided through the use of revolving loan funds or the provision of direct cash assistance to a micro enterprise or self-employed business owner. The target population for this program are TANF recipients and other low-income individuals whose income level does not exceed 100 percent of the official Federal poverty guidelines.

- ELIGIBILITY: Nonprofits having a 501(c)(3) or a 501(c)(4) status with the IRS, other than institutions of higher education. Faith-based organizations are eligible to apply for this program.

- ADDITIONAL INFORMATION: http://www.acf.hhs.gov/programs/ocs/joli/fact_sheet.html

USDA Rural Microentrepreneur Assistance Program (RMAP)

The purpose of the RMAP program is to support the development and ongoing success of rural microentrepreneurs and microenterprises. Direct loans and grants are made to selected Microenterprise Development Organizations (MDOs).

An MDO may borrow a minimum of $50,000 and a maximum of $500,000 for a single loan under this program in any given Federal fiscal year. In no case will the aggregate outstanding balance, of a single MDO, owed to the Agency exceed $2.5 million. A microborrower that has received financial assistance from an MDO is limited to a loan of $50,000 or less. Eligible MDOs will automatically be eligible to receive technical assistance grants to provide technical assistance and training to microentrepreneurs that have received or are seeking a microloan under the RMAP. These grants are limited to an amount equal to not more than 25 percent of the total outstanding balance of microloans made under the RMAP. Technical assistance-only (TA-only) grants will competitively be made to MDOs for the purpose of providing technical assistance and training to prospective borrowers. TA-only grants will be made to eligible MDOs that seek to provide business-based technical assistance and training to eligible microentrepreneurs and microenterprises, but do not seek funding for a direct loan under RMAP. The maximum amount of TA-only grants will not exceed 10 percent of the amount of funding available for TA-only grants as published annually in the Federal Register.

- ELIGIBILITY: Non-profit entities, Indian tribes, and public institutions of higher education that, for the benefit of rural microentrepreneurs and microenterprises, provides training and technical assistance, makes microloans or facilitates access to capital or another related service, and/or has demonstrated record of delivering, or an effective plan to develop a program to deliver such services.

RMAP funding may be used to provide fixed interest rate microloans to rural microentrepreneurs for startup and growing microenterprises. Eligible MDOs will be automatically eligible to receive microlender technical assistance grants to provide technical assistance and training to microentrepreneurs that have received or are seeking a microloan under RMAP. Technical assistance-only grants (for technical assistance and training) may be made to MDOs that have sources of funding other than RMAP funds for making or facilitating microloans. Some examples of eligible projects are loans (working capital, purchase of furniture, inventory, equipment, debt refinancing, business acquisitions, purchase or lease of real estate) and technical assistance grants.

- ADDITIONAL INFORMATION: http://www.rurdev.usda.gov/BCP_RMAP.html

Microloan Programs are already in use in the Gulf Region. Gulf Coast counties and parishes may wish to use some of their state’s microloan programs as models. Local microloan programs include:

- Alabama

- Baldwin County Economic Development Administration Microloan Program (http://www.baldwineda.com/finance/bceda_micro_loan_program.htm)

- Birmingham Business Resource Center

- Florida

- Community Enterprise Investments, Inc.

(http://ceii-cdc.org/?page_id=11)

- Central Florida Community Development Corporation (http://www.cfcdc.com/es_svcs_forms.htm#loans)

- Louisiana

- Greater New Orleans Inc., Microloan Program

(http://gnoinc.org/business-incentives/micro-loan)

- NewCorp Business Assistance Center

- Mississippi

- Alt.Consulting[2]

(http://www.altconsulting.org)

- Texas

- Houston Business Development, Inc. Micro-Enterprise Loans

(http://www.hbdinc.org/loanprograms.php?content=loan-information)

- Accion Texas-Louisiana

- BiGAustin

Also, major national micro-lenders may serve as good resources for local efforts, these include:

- SeedCo (http://www.seedco.org)

- Accion USA (http://www.accionusa.org)

Around the U.S., SBA licenses roughly 170 microlenders. More information can be found at www.sba.gov.

Business and Industry Loans

Some Federal Government Business and Industry Loan Programs Include:

U.S. Small Business Administration Economic Injury Disaster Loans (EIDL)

The Economic Injury Disaster Loan program is designed to assist small business or private, non-profit organizations that have suffered substantial economic injury, regardless of physical damage, and are located in a declared disaster area. Also, small businesses, small agricultural cooperatives and certain private, non-profit organizations of all sizes that have suffered substantial economic injury[3] resulting from a physical disaster or an agricultural production disaster designated by the Secretary of Agriculture may be eligible for the program. The SBA provides EIDL assistance only to those businesses or private, non-profit organizations it determines are unable to obtain credit elsewhere.

- AGENCY: U.S. Small Business Administration (SBA)

- RECIPIENTS: Small businesses, small agricultural cooperatives and most private, nonprofit organizations of all sizes.

- ACTIVATING MECHANISM: Declaration of a disaster by the President, Secretary of Agriculture, or SBA.

- PURPOSE: Working capital loans to help small businesses, small agricultural cooperatives and most private, nonprofit organizations of all sizes meet their ordinary and necessary financial obligations that cannot be met as a direct result of the disaster. These loans are intended to assist through the disaster recovery period. EIDL assistance is available only to entities and their owners who cannot provide for their own recovery from non-government sources, as determined by the U.S. Small Business Administration (SBA).

- ASSISTANCE PROVIDED: The law limits EIDL(s) to $2,000,000 for alleviating economic injury caused by the disaster. The actual amount of each loan is limited to the economic injury determined by SBA, less business interruption insurance and other recoveries up to the administrative lending limit. SBA also considers potential contributions that are available from the business and/or its owner(s) or affiliates.

The $2,000,000 statutory limit for business loans applies to the combination of physical and economic injury, and applies to all disaster loans to a business and its affiliates for each disaster. If a business is a major source of employment, SBA has the authority to waive the $2,000,000 statutory limit.

- COST-SHARING REQUIREMENTS: Not applicable.

- ELIGIBILITY: Only uninsured or otherwise uncompensated disaster losses are eligible. Any insurance proceeds which are required to be applied against outstanding mortgages are not available to fund disaster repairs and do not reduce loan eligibility. However, any insurance proceeds voluntarily applied to any outstanding mortgages do reduce loan eligibility.

- APPLICATION: SBA customer service representatives are available in all disaster recovery centers and SBA disaster loan outreach centers to issue loan applications, answer questions about SBA’s disaster loan program, explain the application process, help individuals complete their applications, and close approved disaster loans. No appointment is necessary to speak with a representative. The Electronic Loan Application (ELA) is accessible via SBA’s secure website at https://disasterloan.sba.gov/ela.

Eligibility to file terminates nine months from the date of the disaster declaration.

- CONTACT:

Office of Disaster Assistance

Small Business Administration

409 Third Street SW

Washington, DC 20416

202-205-6734 / 800-659-2955- ADDITIONAL INFORMATION: http://www.sba.gov/services/disasterassistance/businessesofallsizes/economicinjuryloans/index.html.

- CFDA NUMBER: 59.008 Disaster Assistance Loans

US Department of Agriculture Business and Industry Guaranteed Loan Program

The purpose of the B&I Guaranteed Loan Program is to improve, develop, or finance business, industry, and employment and improve the economic and environmental climate in rural communities. This purpose is achieved by bolstering the existing private credit structure through the guarantee of quality loans which will provide lasting community benefits. It is not intended that the guarantee authority will be used for marginal or substandard loans or for relief of lenders having such loans.

- AGENCY: U.S. Department of Agriculture / Rural Development Business and Cooperative Programs

- RECIPIENTS: Rural businesses from eligible lenders

- PURPOSE: To stimulate economic development in rural communities. A borrower must be engaged in or proposing to engage in a business that will provide employment, improve the economic or environmental climate, promote the conservation, development, and use of water for aquaculture, or to reduce reliance on nonrenewable energy resources by encouraging the development and construction of solar energy systems and other renewable energy systems.

- ASSISTANCE PROVIDED: Guaranteed loans up to $25 million (up to $40 million for rural cooperative organizations that process value-added agricultural commodities.)

- EQUITY REQUIREMENTS: 10 percent for existing businesses and 20 percent for start ups. 25-40 percent for energy projects.

- ELIGIBILITY: Cooperative organizations, corporations, partnerships, or other legal entities organized and operated on a profit or nonprofit basis; Indian tribes on a Federal or State reservation or other Federally recognized tribal groups; public bodies; or individuals who are citizens of the U.S. or reside in the U.S. after being legally admitted for permanent residence and located in a city or town of less than 50,000 people and the contiguous and adjacent urbanized area of such cities or towns.

- APPLICATION: Applicants should consult the office or official designated as the single point of contact in their State for more information on the process required to apply for assistance. Pre-application coordination and an environmental impact assessment may be required for certain projects under this program. A list of offices and additional information can be obtained at http://www.rurdev.usda.gov/recd_map.html.

- CONTACT:

Director, Business and Industry Division

Rural Business-Cooperative Service

U.S. Department of Agriculture

1400 Independence Avenue SW

Room 6853-S

Washington, DC 20250

202-690-4103- ADDITIONAL INFORMATION: http://www.rurdev.usda.gov/rbs/busp/b&i_gar.htm

- CFDA NUMBER: 10.768 Business and Industry Guaranteed Loan Program

USDA Rural Energy for America Programs (REAP)

We face new challenges to reduce dependence on imported oil; to improve the environment; and to make clean, sustainable and affordable energy alternatives available to businesses and agricultural producers. USDA, Rural Development is leading the way by helping rural small businesses and agricultural producers obtain assistance for renewable energy systems (RES) and energy efficiency improvements (EEI). The REAP program encourages the commercial financing of renewable energy systems (bioenergy, geothermal, hydrogen, solar, wind, ocean, and hydro power) and energy efficiency improvement projects. Under the program, agricultural producers and rural small businesses can apply for a grant, loan guarantee, of combination of a grant and loan guarantee.

1. REAP Loan and Grant Assistance.

Rural Energy For America Program Grants/Renewable Energy Systems/Energy Efficiency Improvement Program (REAP/RES/EEI) (http://www.rurdev.usda.gov/BCP_ReapResEei.html)

Rural Energy for America Program Guaranteed Loan Program (REAP LOANS) (http://www.rurdev.usda.gov/BCP_ReapLoans.html)

2. REAP also provides grants for energy audits and renewable energy development assistance.

Rural Energy for America Program Grants/Energy Audit and Renewable Energy Development Assist (REAP/EA/REDA) (http://www.rurdev.usda.gov/BCP_ReapEaReda.html)

3. In addition, the REAP Feasibility Study Program provides grants to conduct a feasibility study for a renewable energy system.

Rural Energy For America Program Grants (REAP Feasibility Study Grants) (http://www.rurdev.usda.gov/BCP_ReapGrants.html)

- AGENCY: Department of Agriculture (USDA) / Rural Development (RD) / Rural Business-Cooperative Service (RBS)

- RECIPIENTS: The REAP loan and grant program is designed to assist farmers, ranchers and rural small businesses. Agricultural producers, including farmers and ranchers, who gain 50% or more of their gross income from the agricultural operations may be eligible. Small businesses that are located in a rural area can also apply.

- PURPOSE: To provide funding opportunities in the form of grants and loan guarantees, for the development of renewable energy systems including wind, solar, geothermal, hydrogen, ocean waves, hydropower, bioenergy, and to implement energy efficiency improvements.

- ASSISTANCE PROVIDED: Loan guarantees, grants, and combination loan guarantees and grants to purchase and install renewable energy systems and make energy efficiency improvements, and conduct feasibility studies. The program also provides funding to perform energy audits and renewable energy development assistance.

- ELIGIBILITY: For REAP loans, grants, combinations, and feasibility studies – agricultural producers and rural small businesses. For energy audits and renewable energy development assistance - State, local, and tribal governments, and colleges and universities, and rural electric cooperatives.

- CONTACT:

U.S. Department of Agriculture / RBS/Energy Division

South Agriculture Building

1400 Independence Avenue SW, Room 6867

Stop 3225

Washington, DC 20250-3225

202-690-1400 (FTS is not available)- ADDITIONAL INFORMATION: http://www.rurdev.usda.gov/Energy.html

- CFDA NUMBER: 10.868 Rural Energy for America Program

U.S. Small Business Administration 7(a) Loan Program

The 7(a) Loan Program is SBA’s primary program to help start-up and existing small businesses obtain financing when they might not be eligible for business loans through normal lending channels.

7(a) loans are the most basic and most commonly used type of loans. They are also the most flexible, since financing can be guaranteed for a variety of general business purposes, including working capital, machinery and equipment, furniture and fixtures, land and building (including purchase, renovation and new construction), leasehold improvements, and debt refinancing (under special conditions). The financing is provided by participating lenders who receive an SBA guaranty on each approved loan to minimize the lender’s risk.

- AGENCY: U.S. Small Business Administration (SBA)

- RECIPIENTS: For-profit small businesses

- ACTIVATING MECHANISM: Small Business Act

- PURPOSE: SBA expands a small business’s access to capital by providing a guaranty to lenders (50 – 85 percent, depending on the loan amount and the program) to minimize the risk to lenders in case of default. Eligible use of proceeds includes working capital, furniture and fixtures, machinery and equipment, leasehold improvements, land and building (to be occupied by the small business), and debt refinancing.

- ASSISTANCE PROVIDED: The maximum 7(a) loan is $5,000,000 to any one small business borrower (including any affiliates).

- COST-SHARING REQUIREMENTS: The small business borrower is charged a guaranty fee. For short term loans (maturity of 12 months or less), the guaranty fee is 0.25 percent of the loan amount. For longer term loans, the guaranty fee is between 2 percent and 3.75 percent of the loan amount, depending on the size of the loan. The lender is also charged an on-going guaranty fee that is paid monthly to SBA based on the outstanding balance of the loan. For FY 2010, the fee is 0.55 percent per year.

- ELIGIBILITY: The business applicant must meet SBA’s definition of “small.” For FY 2010, “small” is defined as tangible net worth that is $15 million or less and average net income after Federal income taxes over the previous 2 years of $5.0 million or less. An alternative size standard available is defined by the NAICS code of the small business. The business applicant also cannot be one of the types of businesses SBA has determined to be ineligible for SBA assistance. A listing of those types of businesses may be found in Title 13, Code of Federal Regulations, part 120.110.

- APPLICATION: The applicant small business should apply to a lender for the financing that the small business requires. There are approximately 5,000 SBA participating lenders. The lender will either approve the loan without an SBA guaranty, approve the loan contingent on receiving an SBA guaranty (at which time the small business and its owners will be required to complete specific SBA forms), or be declined. At www.sba.gov, each SBA district office has its own web page and includes a listing of those SBA participating lenders that are active in their geographic area.

- CONTACT: Lenders wanting to participate as an SBA participant should contact the local SBA district office. A listing of district offices may be found at www.sba.gov. Small businesses may also contact the SBA district office nearest to the location (or proposed location) for further information. In addition, SBA’s website (www.sba.gov) has been designed to assist small businesses with further information as well as resources to assist with business plans.

- ADDITIONAL INFORMATION: www.sba.gov

- CFDA NUMBER: 59.012 Small Business Loans

Small Business Technical Assistance

The U.S. Small Business Administration’s (SBA) organizes technical assistance through resource partners located throughout the country. The network of programs and services supports the training and counseling needs of small businesses. These small business assistance service providers have become part of the state and local economic development fabric and these programs have:

- served over 1.5 M clients in 2010;

- leveraged significantly over $130M in non-federal investment into expanding services to create, sustain and grow small businesses and create jobs; and,

- assisted clients gain access to more than $3.8B in capital.

The Program’s and services within Office of Entreprenership Ddevelopment’s network include:

Small Business Development Centers (SBDCs) – Small Business Development Centers (SBDCs) provide small businesses and aspiring entrepreneurs a wide array of technical assistance support which helps strengthen business performance and sustainability and adds to the creation of new business entities. These small businesses in turn foster local and regional economic development through job creation and retention as a result of the extensive one-on-one long-term counseling, training and specialized services they receive from the SBDCs. The SBDCs exist from a unique collaboration of SBA funding combined with state and private sector resources.

Women’s Business Centers (WBCs) – Women’s Business Centers (WBCs) help ensure women seeking to create, develop and expand small businesses have full access to the necessary business development and expansion tools available through the agency’s entrepreneurial development, lending, and contracting programs. WBCs reach many socially and economically disadvantaged women (and men) who are interested in economic self-sufficiency through owning their own business. WBC’s develop long term relationships with their clients and provide community based resources, customized to the unique needs of the communities where they are based.

SCORE – Representing "Counselors to America's Small Business," SCORE is a nonprofit association dedicated to providing entrepreneurs with free, confidential face-to-face and online business counseling. Mentoring, training, business counseling and workshops are offered through over 300 chapter offices across the country and online.

Entrepreneurship Education (EE) – Entrepreneurship Education (EE) provides SBA oversight for SCORE, and engages in multi-faceted activities to support entrepreneurship including publications aiding small business decision making, reception of visitors from around the globe eager to copy the “American free enterprise dream” at home, outreach to young entrepreneurs, education projects such cyber-security, financial literacy, risk management and disaster preparation, Emerging Leaders (E-200), and the 50+ Program.

Small Business Training Network (SBTN) – The Small Business Training Network (SBTN) is an online training network that operates as a virtual campus, offering over 29 free training courses, workshops, and electronic tools to assist entrepreneurs and other businesses across the country that have broadband access.

Office of Native American Affairs (ONAA) – The Office of Native American Affairs (ONAA) ensures American Indians, Alaska Natives and Native Hawaiians seeking to create, develop and expand small businesses have full access to the necessary business development and expansion tools available through the agency’s entrepreneurial development, lending, and contracting programs. ONAA provides a network of training and counseling services and engages in numerous outreach activities such as tribal consultations, development and distribution of educational materials, attendance and participation in economic development events and assisting AIAN/NH small businesses with SBA programs.

The Center for Faith-Based and Neighborhood Partnerships (FBNP) – The Center for Faith-Based and Neighborhood Partnerships with support from the White House Office of Faith Based and Neighborhood Partnerships, is responsible for leading SBA’s outreach to Faith-Based and Neighborhood organizations. Given the reach and credibility of its stakeholders, the Office of Faith-Based and Neighborhood Partnerships is uniquely positioned to assist in building awareness of SBA programs in underserved markets through community involvement.

Community Development Financial Institutions (CDFI) Fund

The U.S. Treasury’s Community Development Financial Institutions Fund was created for the purpose of promoting economic revitalization and community development in low-income areas through investment in and assistance to community development financial institutions (CDFIs).

Since its creation, the CDFI Fund has awarded $1.11 billion to community development organizations and financial institutions; it has awarded allocations of New Markets Tax Credits which will attract private-sector investments totaling $26 billion, including $1 billion of special allocation authority to be used for the recovery and redevelopment of the Gulf Opportunity Zone. Financial institutions in communities impacted by the oil spill can apply for CDFI status and potentially expand their capacity to provide credit, capital and financial services to underserved populations and communities.

The CDFI Fund achieves its purpose by promoting access to capital and local economic growth through its CDFI Program; New Markets Tax Credit Program; Bank Enterprise Award Program; and Native Initiatives. Summaries of each program are below:

CDFI Program: The purpose of the CDFI Program is to use federal resources to invest in CDFIs and to build their capacity to serve low-income people and communities that lack access to affordable financial products and services. Through the CDFI Program, the CDFI Fund provides two types of monetary awards to CDFIs - Financial Assistance awards and Technical Assistance awards.

- Financial Assistance (FA) Awards: The CDFI Fund makes awards of up to $2 million to certified CDFIs under the FA component of the CDFI Program. A CDFI may use the award for financing capital, loan loss reserves, capital reserves, or operations. FA awards are made in the form of equity investments, loans, deposits, or grants, and the CDFI is required to match its FA award dollar-for-dollar with non-federal funds of the same type as the award itself. This requirement enables CDFIs to leverage private capital to meet the demand for affordable financial products and services in economically distressed communities.

- Technical Assistance (TA) Awards: TA grants allow certified CDFIs and established entities seeking to become certified to build their capacity to provide affordable financial products and services to low-income communities and families. Grants may be used for a wide range of purposes. For example, awardees can use TA funds to purchase equipment, materials, or supplies; for consulting or contracting services; to pay the salaries and benefits of certain personnel; and/or to train staff or board members. The CDFI Fund makes awards of up to $100,000 under the TA component of the CDFI Program.

New Markets Tax Credit (NMTC) Program: Permits taxpayers to receive a credit against Federal income taxes for making qualified equity investments in designated Community Development Entities (CDEs). Substantially all of the qualified equity investment must in turn be used by the CDE to provide investments in low-income communities. The credit provided to the investor totals 39 percent of the cost of the investment and is claimed over a seven-year credit allowance period. In each of the first three years, the investor receives a credit equal to five percent of the total amount paid for the stock or capital interest at the time of purchase. For the final four years, the value of the credit is six percent annually. Investors may not redeem their investments in CDEs prior to the conclusion of the seven-year period.

Throughout the life of the NMTC Program, the Fund is authorized to allocate to CDEs the authority to issue to their investors up to the aggregate amount of $26 billion in equity as to which NMTCs can be claimed, including $3 billion in Recovery Act Awards and $1 billion of special allocation authority to be used for the recovery and redevelopment of the Gulf Opportunity Zone. To date, the Fund has made 495 awards totaling $26 billion in allocation authority.

- Eligibility: An organization wishing to receive awards under the NMTC Program must be certified as a CDE by the Fund.

To qualify as a CDE, an organization must:

- be a domestic corporation or partnership at the time of the certification application;

- demonstrate a primary a mission of serving, or providing investment capital for, low-income communities or low-income persons; and

- maintain accountability to residents of low-income communities through representation on a governing board of or advisory board to the entity.

Native Initiatives: The CDFI Fund's Native Initiatives are designed to overcome identified barriers to financial services in Native Communities. These initiatives seek to increase the access to credit, capital and financial services in Native Communities through the creation and expansion of CDFIs primarily serving Native Communities.

Bank Enterprise Award Program: The Bank Enterprise Award (BEA) Program was created to support FDIC-insured financial institutions around the country that are dedicated to financing and supporting community and economic development activities. The BEA Program complements the community development activities of banks and thrifts by providing financial incentives to expand investments in CDFIs and to increase lending, investment, and service activities within economically distressed communities. Providing monetary awards for increasing community development activities leverages CDFI Fund dollars and puts more capital to work in distressed communities throughout the nation.

CDFI’s are already in extensive use in the Gulf Coast Region. Gulf Coast counties and parishes may wish to use some of their state’s CDFIs as models. Local CDFIs include:

- Alabama

- First Tuskegee Bank.

- Florida

- Community Enterprise Investment Inc.

- Louisiana

- Business Resource Capital Specialty

- Community Development Capital

- Liberty Bank and Trust

- NewCorp Business Assistance Center

- Mississippi

- Mississippi Coast Branch of the Hope Community Credit Union (http://www.hopecu.org)

- Jackson’s Enterprise Corporation of the Delta

- Texas

- Houston’s Pilgrim CUCC Federal Credit Union

- Covenant Community Capital Corp.

- ADDITIONAL INFORMATION: http://www.cdfifund.gov. For a current list of CDFIs by state go to: http://www.cdfifund.gov/what_we_do/programs_id.asp?programID=9

Special Zone Designations

Special zone designations such as HUB Zones, Enterprise Zones and Recovery Zones are ways of providing specialized incentives to certain businesses that meet basic criteria. Federal incentives through these programs as well as additional incentives through the state government are available to a wide variety of communities. Special zone designations also act as redevelopment tools for communities that may want to target investment in certain neighborhoods. Gulf Coast communities could explore the possibility of applying for special zone designations for their targeted economic development areas.

Develop Regional Incentive Packages

Community stakeholders cited the need for an incentive package to attract new businesses. Building on the strengths of the region could yield a basis for a regional incentive program, potentially based on the Florida Quick Action Closing Fund model. The region as a whole could build on this model and explore alternative funding sources to facilitate the regional package. Any incentive program that is implemented could be coupled with workforce development programs to ensure that a suitable workforce is available to attract and support new industry to the region.

Tax Increment Financing (TIF) as an Incentive for Economic Development

TIFs function to capture the projected tax revenue to be created by a new economic development project and invest the funds in project improvements. Essentially, a locality projects the value of increased tax revenues that will be generated by a proposed project; this amount is increased amount is known as the “tax increment”. The locality is then able to dedicate the value of the tax increment within a certain district to finance debt that the locality issues (often in the form of municipal bonds) to pay for the project itself. Localities are, therefore, able to obtain funds for projects by leveraging their future worth. TIFs are widely used throughout the country for various economic development projects.

Many cities have used tax increment financing (TIF). As an example, Mississippi primarily deploys sales tax TIFs, although it is possible to use property tax TIFs as well. It is important to note that there is a difference between project-based and district-based TIFs. While the district-based TIF may take longer to set up, the larger area can provide a larger increment, thus supporting a larger initial investment in, for example, infrastructure.

Venture Capital

Venture Capital is a form of financial capital investment that is generally targeted at early-stage, high-growth and high-potential startup companies. After obtaining an equity interest in a target company, and working to help grow the company’s value, venture capitalists seek opportunities to realize high returns through realization events such as an initial public offering (i.e., “IPO”) or sale of the company. Venture capital can be a good financing option for new companies with high growth potential that are not ready to raise capital in the public markets and not interested or not able to incur additional debt. Attracting venture capitalists is one avenue for spurring business and entrepreneurial growth in the region.

Gulf Coast communities could consider conducting a collaborative effort to identify areas that are ripe for venture capital growth (e.g., alternative energy production, manufacturing, and safety/cleanup, and coastal restoration) and develop a comprehensive strategy for attracting such investors. Beginning steps to this effort could involve the following:

- Identifying venture capital firms that specialize in the region’s target industries and selecting eight to 10 venture capital firms that should be approached

- Learning as much as possible about the funding process for each of the firms

- Working with local businesses to identify exactly how the capital is going to be used.

The National Venture Capital Association (http://www.nvca.org/), a trade association that represents venture capital firms, may provide helpful guidance on identifying potential venture capital partners.

Investment Capital Programs

The mission of the Small Business Investment Company (SBIC) program is to improve and stimulate the national economy and small businesses by supplementing the flow of private equity capital and long term loan funds for the sound financing, growth, expansion and modernization of small business operations while insuring the maximum participation of private financing sources. The SBIC debenture program is a public-private partnership utilizing a government-sponsored “fund of funds” approach to invest long-term capital in privately and managed investment firms that are licensed by the SBA. The program currently manages $8.1 billion in outstanding leverage and commitments.

The SBA also oversees the Small Business Innovation Research (SBIR) program to ensure that the nation's small, high-tech, innovative businesses are a significant part of the federal government's research and development efforts. Eleven federal departments participate in the SBIR program and are required by SBIR to reserve a portion of their R&D funds for award to small businesses[4]. SBIR funds the critical startup and development stages, and the program encourages the commercialization of innovative technologies, products, or services. SBIR is an important contributor that has enhanced the nation's defense, protected our environment, advanced health care, and improved our ability to manage information and data.

Also, the Department of Homeland Security EB-5 visa program provides low-cost equity financing. It is programmed to encourage international investment to bring skilled foreign workers to the U.S. The rules governing this particular program may make it desirable for investors and projects seeking investment. For more information go to: http://www.uscis.gov/portal/site/uscis.

Bank Coalitions

Some Gulf Coast communities have found creative ways to tap the resources of local banks in post-disaster situations. For example, given the need to quickly mobilize funds for small businesses after Hurricane Ike, the Galveston community united in a number of efforts to fill funding gaps. Between September 13 and December 31, 2008, Galveston banks reinvested almost $50 million to local businesses impacted by Hurricane Ike. This program was initiated within three weeks of Ike’s landfall. Four local participating banks united in recognition of the business community’s plight. Together, with facilitation from the Galveston Economic Development Partnership, they formed a short-term (180-day), low-interest (5 percent) single pay note for viable businesses needing working capital as a result of the hurricane. This model could be useful in many post-disaster community development scenarios.

[1] Unlike many other revolving loan programs, this program serves county and municipality governmental authority applicants.

[2] Headquartered in Arkansas, but providing services in parts of Mississippi.

[3] Substantial economic injury is the inability of a business to meet its obligations as they mature and to pay its ordinary and necessary operating expenses.

[4] The eleven participating agencies are: Department of Agriculture, Department of Commerce, Department of Defense, Department of Education, Department of Energy, Department of Health and Human Services, Department of Homeland Security, Department of Transportation, Environmental Protection Agency, National Aeronautics and Space Administration, National Science Foundation.